Revenue Curves of an Individual Firm Under Perfect Competition:

While discussing the assumptions of perfect competition, we have stated that in a perfect

competition, the number of buyers and sellers is so

large that an individual buyer or an individual seller cannot

influence the market price.

A firm has to sell its products at

the market price prevailing in the market. The buyers have also

perfect knowledge of the quality and prices of the commodities

which they wish to purchase. Similarly, a factor knows the

reward which is paid to the similar factor in the country. In

addition to these, the factors of production are perfectly

mobile. They can freely move from one place to another place,

from one occupation to another occupation, and no artificial

barriers are imposed upon them by the state. The sellers sell

identical and homogeneous goods.

Under the conditions stated above,

there will be one price for the identical goods in all parts of

the market. If any seller wishes to sell its goods at a price

lower than the market price, its goods will be sold in no time

as all the buyers have perfect knowledge of the market. If he

keeps the price higher than the market price, the goods will not

be sold. The seller in order to get the maximum profit will have

to sell its total output at the prevailing market price as is

shown in the two figs. given below:

Diagram/Figure:

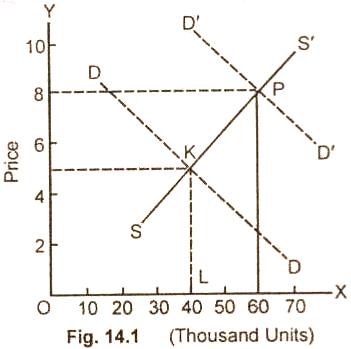

In the fig. (14.1) markets demand

and supply curves intersect at point K. KL, i.e. $5 is the

market price.

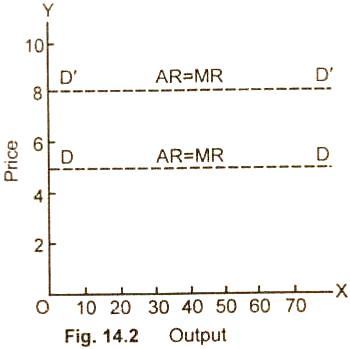

In Fig. (14.2) DD is the demand curve which an

individual firm has to face. A firm whether it produces 5 units

or 50 units has to sell its product at the prevailing market

price, i.e., at $5. If at any time the aggregate demand rises,

and the price settles at PR (i.e., $8), then an individual

seller can sell its products at $8. He will face the new demand

curve D1 D1 as is shown in fig. (14.2).

Under perfect competition, the

additional output is sold at the price at which, the first unit

is sold. The average revenue curve is, therefore, always equal

to marginal revenue and so both the curves AR and MR coincide.

For instance, when the market

prices of a commodity is $5 per unit, the firm sells 10 units.

The total revenue of the firm is $50. If it wishes to sell 11

units, an individual firm cannot alter the market price. So it

has to sell the additional units also at $5. The total revenue

of the firm by selling 11 units will be $5. The addition made to

the total revenue by selling one more unit, i.e.. MR is $5. The

average revenue is also found by dividing the total revenue by

the number of goods sold $( 50 / 10 = 5, 55 / 11 = 5, 60 / 12 =

5). We therefore, find that in perfect competition marginal

revenue, average revenue and price are the same. So these curves

also coincide as is illustrated in the schedule and diagram.

Schedule:

|

Units |

Price Per Unit ($)

|

Total Revenue ($)

|

Marginal ($)

|

Average Revenue ($)

|

|

10 |

5 |

50 |

5 |

5 |

|

11 |

5 |

55 |

5 |

5 |

|

12 |

5 |

60 |

5 |

5 |

|

13 |

5 |

65 |

5 |

5 |

|

14 |

5 |

70 |

5 |

5 |

|

15 |

5 |

75 |

5 |

5 |

|

16 |

5 |

80 |

5 |

5 |

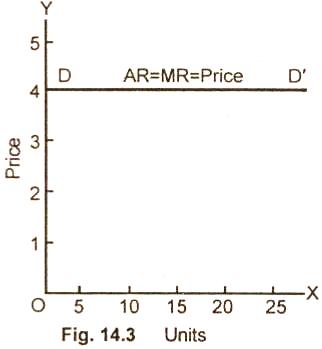

The

demand curve which a firm has to face in a perfect

competitive market is a horizontal straight line parallel to

the quantity axis. The MR and AR curves coincide with the price

line DD/. Here MR = AR = Price as is shown in figure

14.3.

Relevant Articles:

|