Classic economics covers a century and a half of economic teaching.

Adam

Smith wrote a classic book entitled, 'An Enquiry into the Nature and Causes of

the Wealth of Nations' in 1776. Since the publication of that book, a body of

classic economic theory was developed gradually. However, the classic theory

owes its origin to the works of David Ricardo (1772 -1823), T. S. Mill, J. B.

Say and finally ends with the works of A. C. Pigou (1877-1959).

There is no one single theory which can be

labeled as classical

theory of employment. In fact the classical theory of employment is composed of

different views of classical economists on the issue of income and employment in

the economy.

According to the classical economists, the economy normally

operates at the level of full employment without inflation in the long period.

They assumed that wages and prices of goods were flexible and the competitive

market existed in the economy (laisse-fair economy). The classical model,

however, did not rule out the existence of over production and hence

temporary unemployment in the economy.

According to classics, if market forces are allowed to operate in the

economic system, they will eliminate over production and make the economy

produce output at the level of full employment. The classical economists were of

the view that when the economy was at full employment level, that did not

mean non existence of unemployed workers. Even at full employment level, there

would be workers who would be frictionally or voluntarily unemployed. In a

normal situation, if prices and wages are assumed to adjust freely and quickly,

then in the commodity and labor market, the economic system will operate

at the level of full employment in the long run.

Principles of

Classical Theory of Employment:

The classical theory of employment is

based on the following principles:

(1) Say's Law of Market.

(2) Equilibrium in the Labor Market.

(3) Classical Analysis of Price and

Inflation.

(1) Say's Law of Market:

J. B. Say (1776 - 1832) was a French economist and an industrialist. He was

influenced by the writings of Adam Smith and David Ricardo. According to J. B.

Say:

"When goods are produced by firms in the economy, they pay reward to the

factors of production. The households after receiving rewards of the factors of

production spend the amount on the purchase of goods and services. From this it

follows that each product produced in the economy creates demand equal to its

value in the market".

This conclusion came to be known as

Say's Law of Market.

Statement and

Explanation of Say's Law of Market:

"Say's Law of market states that supply creates its own demand".

The income a

person receives from production is spent to purchase goods and services by

others. For the economy as a whole, therefore, total production equals total

income.

From this it implies that when the production of goods generate income

sufficient to purchase goods, then there will be no deficiency of demand for

goods, there will be no over production of goods and so no lay off or genera!

unemployment for the workers. The essence of Say's law is that whatever the

economy generates is automatically spent on the purchase of goods and services

The economy is, therefore, self correcting. Its market always clear. Because of

this self-adjustment, the economy operates automatically to full employment

level as if guided by Adam Smith's "Invisible hand".

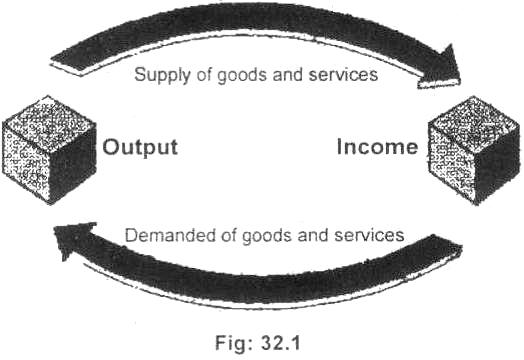

Diagram/Figure:

Say's Law is explained with the help of simplified circular flow in figure

32.1. Says Law means that supply creates its own demand for goods and services.

The income persons receive from output is spent to purchase goods and services

produced by others. The very act of supplying certain level of goods and

services necessarily equals the level of goods and services demanded. For the

economy as a whole, total production therefore equals total income.

Assumptions of the

Say's Law of Market:

The classical model is based mainly

on the following four assumptions:

(i) Pure competition exists. No single buyer or seller of commodity or an

input can affect its price.

(ii) Wages and prices are flexible. The wages and prices of goods are free to

move to whatever level the supply and demand dictate.

(iii) Self interest. People are motivated by self interest. The businessmen

want to maximize their profits and the households want to maximize their

economic well being.

(iv) No government interference. There is no necessity on the part of the

government to intervene in the business matters.

It may here be noted that if a part of the economy's income is saved, the

Say's Law of Market would still hold good, It is because of the reason that

whatever amount is saved is invested by businessmen on capital goods. Saving is

equal to investment. Aggregate spending thus will be equal to aggregate income

and the economy operates at the level of a full employment.

The classical economists, however, maintained that if at any time there is

divergence between saving and investment, the equality between the two is

maintained through the mechanism of rate of interest. For example, if at any

time, the flow of savings is greater than the flow of investment, the rate of

interest will fall. This will lead to an increase in investment and fall in

saving till the two are equal at the full employment level. We find from Say's

Law of Market, that saving is an increasing function of the interest rate and

investment a decreasing function of the rate of interest.

(2) Equilibrium in the

Labor Market:

Another feature of the classical theory of employment is in its belief that

that if real wages of the workers are flexible in the labor market, then the

economic system automatically adjusts itself at the level of full employment.

According to A. C. Pigou:

"The equilibrium level of employment is determined by

the demand for and supply of labor in the labor market. So far the demand for

labor is concerned, it is the decreasing function of higher wages. This means

that at higher wages, the firms will employ less units of workers. As the real

wage rates fall, then more units of workers are demanded by the firms".

As regards the supply of labor, it is the increasing functions of real

wages. This means that at higher wage rates, more workers will be willing to

work. The equilibrium level of employment which is the full employment level is

determined by the equation of demand for and supply of labor. The classical

theory of employment is now explained with the help of diagram.

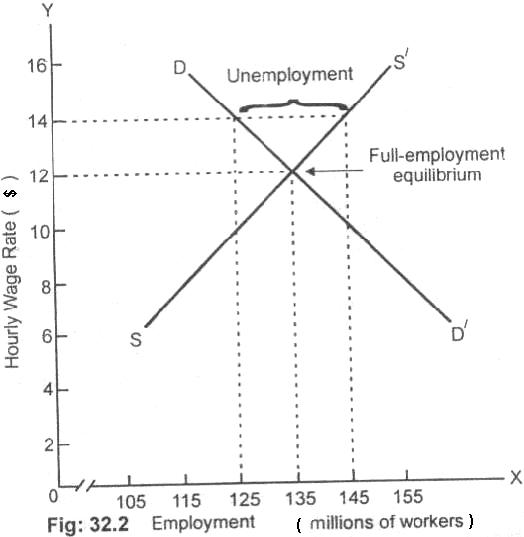

Diagram/Figure:

In the Fig. 32.2, the labor demand curve DD/ shows the total quantity of

workers that firms plan to hire at each possible real wage rates. The labor

supply curve SS/ shows the total quantity of workers that households plan to

supply at each possible wage rate. The labor demand curve

DD/ and the labor

supply curve

SS/

interact to determine the level of employment.

In this fig, it

is shown that when the real wage rate is $12 per day, then 135 million

workers employed represented full employment equilibrium. In case the real wage

rate is $14 per day, the supply of workers is 145 million whereas the firms

would want to hire only 125 million workers, there would be surplus labor or

unemployment of 20 million workers. In the classical model, the unemployment of

20 million workers will be eliminated by real wage rate dropping to $12 per

day. At wage rate below $12 per day, there is labor shortage. The situation

of labor shortage does not last for a longer period. The real wage rate rises

to $12 per day with full employment equilibrium of 135 million workers.

(3) Classical Analysis of

Prices and Inflation:

The classical economists were of the view also that price level (P) in the

economy is dependent upon the supply of money (M) in the country. The greater

the quantity of money, the higher is the price level and vice versa. This

analysis of price level was based on the Quantity Theory of Money, which in

brief rates that price level (P) is directly related to the quantity of money in

circulation in the economy (M).

Keynes Criticism on Say's Law:

The law of J.B. Say was finally falsified and laid to rest with the writings

of Lord J.M. Keynes. He in his book, 'General Theory', has severally criticized

the Say's Law on the following grounds:

(i) Possibility of deficiency of effective demand. According to Keynes, the

classical theory based on Say's Law is unreal. In a competitive market, he says,

it is not necessary that all income earned is automatically spent on consumption

and investment. A part of income may be saved and may go to increase individual

holdings. There may, thus, appear a deficiency in aggregate demand causing

overproduction and unemployment in the country.

(ii) Pigou's view on wage cuts. Keynes criticizes

Pigou's view that a general

cut in real wages in times of depression is a cure for unemployment. Keynes is

of the opinion that a general cut in real wages may reduce the aggregate demand

for goods and deepen depression.

(iii) Not a general theory. The Say's Law assumes that micro economic analysis

can profitably by applied to the economy as a whole. Keynes rejects this view

and says that for the explanation of the general theory of income and

employment, the macro economic analysis is required.

(iv) Saving investment equality. Keynes was never convinced of the classical

version that interest elasticity can equate savings and investment. According to

him, it is the income and not the rate of interest which is the equilibrium,

force between saving and investment.

(v) Monopoly element. Say's Law assumes perfect competition in the economy.

Keynes says it is the imperfect competition which in practice prevails in the product and factor markets. The Say's Law is therefore, not

operative.

(vi) Role of trade unions. In the contemporary capitalist world,

the trade unions bargain with the employers for the fixation of wages. The state

also fixes minimum wages in certain industries. The classical theory did not

attach much importance to these forces and relied more on the theoretical;

aspect, J.M. Keynes emphasizes more on the practical side of the theory of

employment. In the words of Dillard" the great fault of the classical theory is

its irrelevance to conditions in the contemporary capitalist world. In

capitalistic economy where widespread unemployment, business cycles, inflation, and other forms of instability constitute the chief problems of public

policy, the basic need is for a theory that will diagnose these ills in a manner

which wilt furnish a guide to action for their solution or alleviation. Such a

new and more relevant theory has emerged in Keynes General Theory of Employment,

Interest and Money.

(vii) Short run economics.

Keynes rejects Says Law that aggregate demand will always be sufficient to

buy what is supplied in the long run. Keynes remarks that "In the long run we

are all dead". The length of long run is not clear in Say's Law.