Equilibrium of Demand and

Supply:

Meaning and Definition:

The price of

a commodity in the market is determined by the interaction of the forces of

demand and supply. By "demand for a commodity" at a given price is meant:

"The total quantity of that commodity

which buyers will take at different prices per unit of time".

While

"supply of a commodity" at a given price refers to:

"That

quantity of the commodity which sellers are willing to offer for sale at

different prices per unit of time".

If we

construct a list or table of the different amounts of the commodity which

consumers purchase at different prices in the market, we get the market demand

schedule. Similarly, supply schedule is a list or a table of different amounts

of the commodity that are offered for sale in the market at different prices per

unit of time.

In the

market, there are large number of buyers and sellers. It is the desire of every

buyer in the market to purchase a commodity at the lowest possible price while

the sellers wish to sell it at the highest possible price.

When buyers compete

among themselves for the purchase of particular commodity, the price of that

commodity goes up and when there is competition amongst the sellers, the price

comes down.

Equilibrium Price:

The price of a commodity tends to settle at a point where the

quantity demanded is exactly equal to the quantity supplied. The price at which

the buyers and sellers are willing to buy and sell an equal amount of commodity,

is called the, equilibrium price. We illustrate the above proposition

with the help of a schedule and a curve.

Schedule:

|

Quantity Supplied (Cooking Oil Kg) Per Week |

Price

(Dollars) |

Quantity Demanded (Cooking Oil Kg) Per Week |

|

800

600

500

450

|

19

18

17

16

|

100

250

400

450

|

|

350

100

|

15

14 |

500

700

|

If we study

the above schedule carefully, we will find that when the price of cooking oil is

$16 per kilogram, the total quantity demanded in a week is exactly equal to the

total quantity supplied. So $16 is the equilibrium price for the period and the

equilibrium amount, i.e. the quantity demanded and offered for sale is 450

kilograms of cooking oil is:

Equation:

Qd = Qs

If the

conditions assumed above remain the same, then there can be no equilibrium price

other than $16.

Example:

For instance,

if the price of cooking oil happens to rise to$18 per kilogram. At this price, the

sellers are anxious to sell 600 kilograms of ghee but the buyers are willing to,

buy only 250 kilograms. The sellers will compete with one another to dispose off

this surplus stock. The competition among the sellers will result in lowering

the price. When the price comes down to $16

(i.e., the equilibrium price), then the whole of the stock will be sold.

Conversely,

if the price happens to fall to $14 per kilogram, the buyers would like to buy

700 kilograms of cooking oil, but the sellers are willing to sell only 100

kilograms. The buyers, in order to buy more cooking oil at a lower price will

compete among themselves. This competition among the buyers will increase the

price of ghee. Finally, the price will be reestablished at the equilibrium price

which is $16.

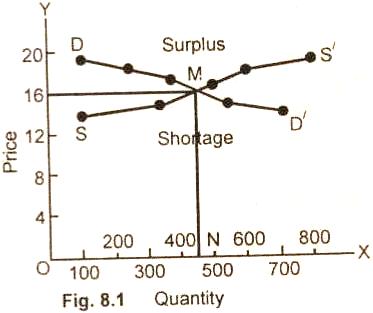

Diagram/Figure:

The

determination of the equilibrium price can be proved graphically.

In the figure

(8.1) DD/ is the demand curve which, represents the different amount

of .the commodity that are purchased in the market at different prices, SS/

is the supply cure which indicate, the amount of the commodity that is offered

for sale at different prices per unit of time.

MN is the equilibrium price i.e.,

$16 and ON 450 kg. is the equilibrium amounts. If the price is below

the equilibrium price ($16), there are upward pressure on price due to the

resulting shortage of good. In case, the

price is above the. equilibrium, there is a downward pressure on price caused by the resulting surplus of good. If is

only at price MN, the buyers take of the

market exactly what sellers place on the market.

Relevant Articles:

|