J. M. Keynes in his famous book 'General Theory' put forward an analysis of

unemployment and inflation. The Keynesian theory assumes that a maximum level of

national output can be obtained at any particular time in the economy. According

to him the maximum level of national income is generally referred to as full

employment level of national income. If the equilibrium level of national income

coincides with the full employment, there will be no deficiency of aggregate

demand and hence no dis-equilibrium unemployment (seasonal, frictional

unemployment can exist at this level).

Now if the equilibrium level of income as determined by the AD (aggregate

demand) and AS (aggregate supply) is not equal to the level of full employment,

then two situations can arise. Either this equilibrium level will be below the

full employment level or above the lull employment level. In case, the

equilibrium income is below the potential income, it indicates the presence of

recessionary gap. If it is above the full employment income, it shows the

presence of inflationary gap. Both the situations of deflationary and

inflationary gaps are situations of disequilibrium in the economy. These gaps

are now explained with the help of graphs.

Deflationary

Gap/Recessionary Gap:

Definition and

Explanation:

Deflationary gap is also called

re-cessionary gap. When there is an

insufficient demand for goods and services in the economy, the equilibrium will

occur at the lower level of full employment income and to the left of full employment line. In other words, re-cessionary gap occurs when the aggregate

demand is not sufficient to create conditions of full employment.

The

deflationary gap thus is the difference of amount by which aggregate

expenditure falls short of the level needed to generate equilibrium national

income at full employment without inflation.

Example and

Diagram/Figure:

The deflationary gap is

illustrated in figure below:

In this diagram 31.4, the national income is measured on OX axis and

aggregate expenditure on OY axis. Let us assume initially that the aggregate

expenditure curves AE° interests the 45 degree line at point E/ to the left of

full employment line or potential income.

The economy is operating at

equilibrium income level of $150 billion which is below potential income of $250 billion. There is a deficiency of

$100 billion in aggregate

expenditures. This shortfall of national expenditure ($100 billion) below the

potential income or the full employment level of national income is called

Re-cessionary Gap.

Fighting Recession:

When the economy is operating below its potential

income, the government recognizes the re-cessionary gap in aggregate income. It

increases its expenditures to stimulate the economy. The multiplier process

takes over. The increase in government expenditure shifts the AE/ curve from AE°

to AE1 increasing aggregate income to the full employment income level.

Such government action is expansionary fiscal policy.

Deflationary gap thus represents the difference between the actual aggregate

demand and the aggregate demand which is required to establish the equilibrium

at full employment level of Income.

Inflationary Gap:

Definition and

Explanation:

An inflationary gap is just the opposite of deflationary gap. It is said to

exist when equilibrium income exceeds full employment income. It is created due

to the effective demand being in excess of the full employment level. It is the

difference between equilibrium income and full employment income (potential

income) when equilibrium income exceeds the full employment income. Here people

are trying to buy more goods and services than can be produced when all

resources are fully employed. There is too much money chasing too few goods. The

result is that the excess demand pulls up prices and there is inflation. The excess demand for goods and services is being

met in money terms but not real, terms.

Example and

Diagram/Figure:

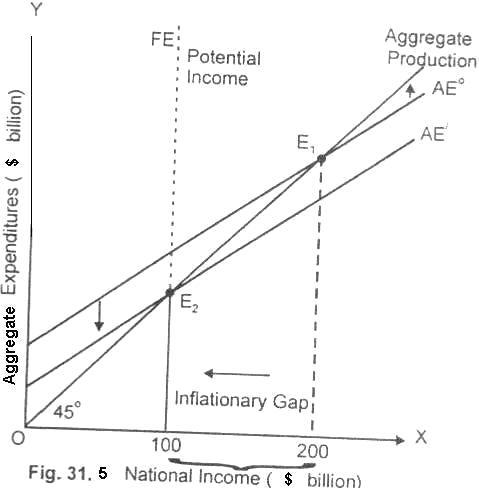

An inflationary gap is explained with the help of figure below:

In this figure 31.5 aggregate expenditure curve AE° intersects the aggregate

production curve (45 degree helping line) at point E/ to the right of potential

line or full employment line (FE).

The equilibrium level of income is $200

billion whereas the potential income is $100 billion. When the equilibrium

income exceeds potential income, there is said to be inflationary gap which in the

diagram is $100 billion. The excess expenditure of $100 billion causes

upward pressure on prices when there is no additional output produced.

Fighting Inflation:

Whenever there is an inflationary gap in the economy, the government adopts

deflationary fiscal policy of lowering government expenditure or raising taxes.

It also adopts deflationary monetary policy for reducing the amount of money in

the economy.

Summing Up:

(i) When equilibrium income is below its potential income level, the

difference is called deflationary gap. The government can increase its

expenditure to stimulate the economy.

(ii) When equilibrium income exceeds the potential income, the difference is

called an inflationary gap. To prevent inflation. Keynes believes that the

government should exercise contractionary fiscal policy, cutting government

expenditure, raising taxes etc.