Price and Output Determination Under

Discrimination Monopoly:

Price

discrimination takes place when a given product is sold by a monopolist at more

than one price and these price differences are not justified by cost

differences. The price discrimination is possible under the following

conditions.

Conditions:

(1)

Monopoly power.

The seller of a good must be a

monopolist.

(2)

Segregation of market.

The monopolist must be able to segregate

buyers into separate classes with different price elasticities.

(3)

No reselling.

There should be no possibility of reselling the good from a

tow price market to a high price market.

Purpose of Price Discrimination:

The

purpose of price discrimination by a monopolist is two fold. Firstly, to

increase his total revenue and profits and secondly, to produce a larger output

than a non-practicing monopolist. Determination of price and output under

monopolistic competition.

Price

discrimination is possible and profitable when the monopolist is able to control

the amount and distribution of supply and the buyers can be separated into

different classes having a demand curve with different elasticities. Let us

assume that the monopolist sells his total product in two sub-markets A and B.

Sub-market A has low price elastic demand for the product and the sub-market B

has high price elasticity of demand. The discriminating monopolist will sell a

greater quantity of his product by making a price reduction in market B. He

sells lesser commodity in market A at a price higher than in market B. The

monopolist will then earn maximum profit by price discriminating as is

illustrated with the help of diagram given below.

Diagram:

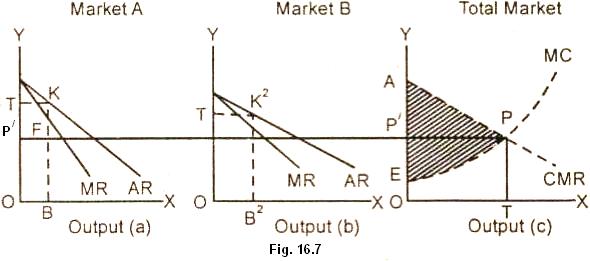

In this

figure (16.7) market A and Market B have different elasticity of demand for the

product of the monopolist. The slopes of the AR and MR curves in each market are

different depending upon the elasticity of demand for the commodity. In market

A, the elasticity of demand is relatively

inelastic. The rise in price does not cause a much fall in demand. In market

B, the demand for the monopolist product is relatively elastic.

A

reduction in price leads greater increase in the demand for the product and adds

more to the revenue. In figure, the combined marginal cost curve (MC) of the

total output of the monopolist intersects the combined marginal revenue curve of

the two markets A and B from below at point P. The best levels of output of the

monopolist is OT given by the point P where MC curve cuts the AR curve from

below. The monopolist Is to distribute this equilibrium output OT between the

two markets A and B in such a way that the MR in each market is OP.

In market

A, MR equates MC at point F. The monopolist sells output OB at price KB. In

market B, where the demand is more elastic, the monopolist maximizes profit by

selling output OB2 at price K2B2 in market B,

where the demand is more elastic, the price K2B2 is lower

than in market A, the profit of the monopolist is maximum when he sells output

of OB at price KB in market A and

output of OB2 at price of K2B2 in market B. The

monopolist total profit is shown in the shaded area APE in figure 16.7c.

Summing up, a discriminating monopolist can maximize profits only when:

(1) It is

profitable for him to sell the output in different markets.

(2) The

price is charged in different markets in such a way that the last unit of the

commodity sold in market gives the same marginal revenue.

(3) The

marginal revenue is equal to the marginal cost of total output.

Relevant Articles:

|