Three Important

Economic Models of

Oligopoly

are as:

(1) Price and output

determination under collusive oligopoly.

(2) Price and output

determination under non-collusive oligopoly.

(3) Price leadership

model.

(1)

Price and Output Determination Under Collusive Oligopoly:

The term

'collusion' implies to 'play together'. When firms under

oligopoly agree formally not to compete with each other about

price or output, it is called collusive oligopoly.

The firms may agree on setting output quota, or fix prices or

limit product promotion or agree not to 'poach' in each other's

market. The completing firms thus from a 'cartel'. The members

of firms behave as if they are a single firm.

Assumptions of Price and Output Determination Under Collusive

Oligopoly:

For price output

determination in a collusive oligopoly, we assume that (i) there

are only three firms in the industry and they form a cartel,

(ii) the products of all the three firms are homogenous (iii)

the cost curves of these firms are identical.

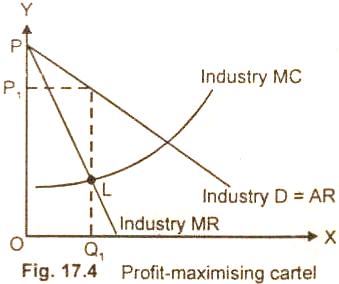

Under the assumptions

stated above, the equilibrium of the industry under collusive

oligopoly is explained with the help of a diagram.

Diagram:

In this figure 17.4,

the industry demand curve DD consisting of three firms is

identical. So is the case with the MR curve and MC curve which

are identical. The cartel's MR curve intersects the MC curve at

point L. Profits are maximized at output OQ1, where

MC = MR. The cartel will set a price OP1, at which OQ1,

output will be demanded.

Having agreed on the

cartel price, the members may then complete each other using non

price competition to gain as big share of resulting sales OQ1

as they can.

There is another

alternative also. The cartel members may agree to divide the

market between them. Each member would given a quota. The sum of

all the quotas must add up to Q1. In case the quotas

exceeded OQ1 either the output will remain unsold at

OP price or the price would fall.

(2)

Price and Output Determination Under Non-Collusive Oligopoly:

It will be explain

with the help of kinked Demand Curve Model.

(i)

The Kinked Demand Curve Model:

The Kinked

demand curve model was developed by Paul Sweezy (1939).

According to him, the firms under oligopoly try to avoid any

activity which could lead to price wars among them. The firms

mostly make efforts to operate in non price competition for

increasing their respective shares of the market and their

profit. An analytical device which is used to explain the

oligopolistic price rigidity is the Kinked Demand Curve.

This model operates

on fulfilling certain conditions which, in brief,

are as under:

(a) All the firms in

the industry are quite developed with or without product

differentiation.

{b} All the firms are

selling the goods on fairly satisfactory price in the market.

(c) If any one firm

lowers the price of its product to capture a larger share of the

market, the other firms follow and reduce the price of their

goods in order to retain their share of the market.

(d) If one firm

raises the price of its goods, the other firms will not follow

the price increase. Some of the customers of the price raising

firm will shift to the relatively low priced firms.

Mr. Paul Sweezy used

two demand curve concepts to explain the model. These are

reproduced below:

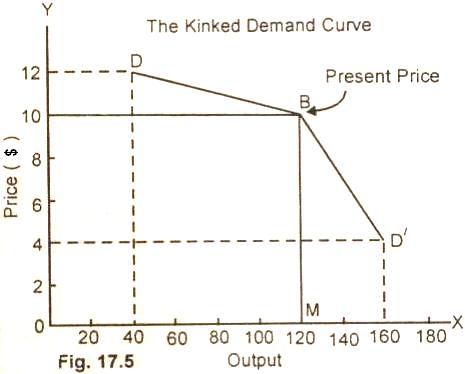

Diagram:

In the figure 17.5.

DD/ is a kinked demand curve. It is made up or two segments DB

and BD/. The demand curve is kinked Or has a bend at point B. The

kink is formed at the prevailing market price level BM ($10

per unit). The segment of the demand curve above the prevailing

price level ($10) is highly elastic and the segment of the

demand curve below the prevailing price level is fairly

inelastic. This is explained now in brief.

Explanation:

Price increase. If an

oligopolistic raises the price of his products from $10 per

unit to $12 per unit, he loses a large part of the market

and his sale comes down to 40 units from 120 units. There is a

loss of 80 units in sale as most of his customers are now

purchasing goods from his competitor firms who are selling the

goods at $10 per units. So an increase in price above the

prevailing level-shows that the demand curve to the left of and

above point B is fairly elastic.

Price reduction. If

an oligopolistic reduces the prices of its goods below the

prevailing price level BM ($10 per unit) for increasing his

sales, his competitors will also match price changes so that

their customers do not go away from them. Let us assume that

Oligopolist has lowered the price to $4.0 per unit. Its

competitors in the industry match the price cut. The sale of the oligopolist with a big price cut of

$.6.0 per unit has

increased by only 40 units (160 - 120 = 40). The firm does not

gain as the total revenue decreases with the price cut. The BD/

portion of the demand curve which lies on the right side and

below point B is fairly inelastic.

Rigid Prices. The

firms in the oligopolist market 'have no incentive to raise or

lower the prices of the goods. They prefer to sell the goods at

the

prevailing price

level due to reaction function. The price BM ($10 per unit)

will, therefore, tend to remain stable or rigid, as every member

of the oligopoly does not see any gain by lowering or raising

the price of his goods.

(3) Price

Leadership

Model:

The firms in the

oligopolistic market are not happy with price competition among

themselves. They try various methods to maximize joint profits.

Price leadership is one of the means which provides relief to

the firms from the strains of price competition.

The firms in the

oligopolistic industry (without any formal agreement) accept the

price set by the leading firm in the industry and move their

prices in line with the prices of the leader firm. The

acceptance of price set by the price leader firm maximizes the

total profits of each firm in the oligopolistic industry.

Assumptions:

The main assumptions

of price leadership model under oligopoly are as under:

(a) There are two

firms A and B in the market.

(b) The output

produced by the two firms is homogeneous.

(c) The firm 'A being

the low cost firm or a dominant firm acts as a leader firm.

(d) Both of the firms

face the same demand curve.

(e) Each of the two

firms has an equal share in the market. The price and output

determination under price leadership is now explained with the

help of the diagram below.

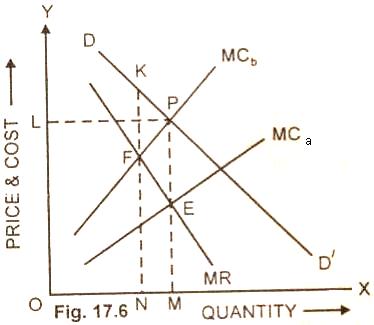

Diagram:

In this figure 1 7.6,

DD/ is the demand curve which is faced by each of the two

firms. MR is the marginal revenue curve of each firm. MCa

is the marginal cost of firm A and MCb is the marginal cost of

firm B. We have assumed that the firm A is a low cost firm than

firm B. As such the MCa lies below MCb.

The leader firm using

the marginalistic rule of MC = MR is in equilibrium at point E.

The firm A maximizes profits by selling output OM and setting

price MP. The firm B

is in equilibrium at point F where MCb = MR.

The firm B

maximizes profits by producing ON output and selling it at NK

price. The firm B has to compete firm A in the market, if the

firm B fixes the price NK per unit, it will not be able to

compete with firm A which is selling goods at MP price per unit.

Hence, the firm B will be compelled to follow the leader firm A.

The firm B will also charge MP price per unit as set by the firm

A. The firm B will also produce QM output like the firm A. Thus

both the firms will charge the same price MP and sell each of

them OM output. The total output will thus be twice of OM.

The firm A being the

low cost firm will maximize profits by selling OM output at MP

price. The profits of the firm B is lower than of firm A because

its costs of production is higher than of firm A.

Conclusion:

After studying the

pricing and output decisions under various forms of oligopoly,

the main conclusion drawn is that allocate and productive

efficiency are unlikely to be achieved under them. However,

Schumpeter's view Is that oligopolists have both the Incentive

and financial and technical resources to be more technological

progressive than competitive firms.