Concept of

Investment:

Definition:

Investment is an important

component of national income. It plays an important role in the determination of

equilibrium level of national income and corresponding level of employment. When

the term investment is used in economics, it refers to the:

"Expenditure incurred by individuals an businesses on the purchase of new plant

and machinery, the building of the houses,

factories, schools, construction of roads etc. It is, in other words the

acquisition of new physical capital".

Investment Expenditures:

Investment, in brief, includes

the following kinds of expenditures:

(i) Stock or

Inventories:

The

inventories expenditures incurred

by businesses on the purchase of new raw material, semi finished gods and on

stock of unsold goods (inventories) are counted as investment.

(ii) Fixed

Capital:

The expenditure made on new plants and

machinery vehicles, houses facilities, etc., are also included in investment. In

the words of J.M. Keynes:

"Investment means real investment which refers to

increase in the real capital stock of the economy".

Types of Investment:

There are two types of investment (1) Induced investment

and (2) Autonomous investment.

There two

are now explained brief:

(1) Induced

Investment:

Investment in the economy is influenced

by the income or output of the economy. The large the national income, the

higher is the investment. Induced investment is the change in investment which

is induced by the change in the national income. The investment function

signifies that as the real national income rises, the level of inducement

investment also rises and as the real national falls. The level of investment

also down.

Diagram:

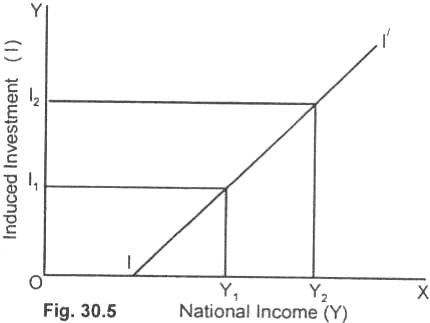

In figure (30.5), it is shown that investment curve I/ is

positively sloped. It indicates that as the level of national income rises from OY1 to OY2, the level of induced investment also rises from OI1 to OI2.

Shift in the

Investment Curve: The induced investment is

the increasing function of profit. If firm expect profit, they are induced to

invest. The profit expectation of firms depend upon aggregate demand for goods

and services in the economy. The level of aggregate demand itself depends upon

the level of national income. The higher the level of national income, the

higher thus is the level of induced investment.

(2) Autonomous

Investment:

The

investment which is not influenced by changes in national income is

autonomous investment. In other words an autonomous investment is

independent of the level national income.

As regards the size of autonomous investment, it is

influenced by many basic factors such as increase in population. Manpower, level

of technology, the role of interest, the expectations of future economic growth

and the role of capacity utilization etc.

Diagram:

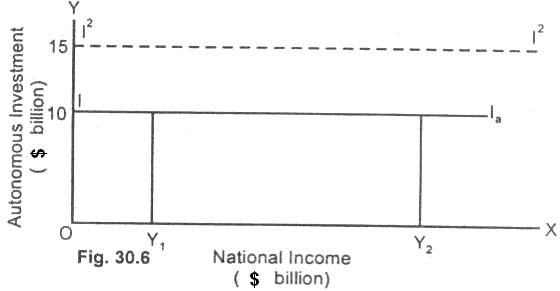

In figure (30.6) it is shown that autonomous investment

curve Ia is a horizontal straight line. For example, when national income is OY1

the autonomous investment is $10 billion. If national income increases to OY2

the autonomous investment remains $10 billion and so on.

In case, there is an introduction of new technologies, or

the rate of interest falls or if the businessmen expect the sales to grow more,

the producer choose to operate to full capacity, the autonomous investment is

influenced. The autonomous investment curve shifts upward from $10 billion to $15 billion.

Relevant Articles:

|