Psychological Law of Consumption By J.M Keynes:

J.M. Keynes, in his book

‘General Theory’ analyzed the consumption behavior of the

community on the basis of human psychology. He propounded a law

which is known as Psychological Law of Consumption.

Statement:

According to this law:

"The household sector spends a major

part of its income on the purchase of consumer goods and

services such as food, clothing, medicines, shelter etc., for

personal satisfaction. The expenditure on consumption (C) is the

largest component of aggregate expenditure. Whatever is not

consumed out of disposable income is by definition called saving

(S)".

Formula:

Disposable Income =

Consumption + Saving

I = C + S

Explanation:

According to Keynes, the level of

consumption in a community depends upon the level of disposable

income. As income increases, consumption also increases but it

increases not as fast as income i.e., it increases at a

diminishing rate. This relationship between consumption and

disposable income is called consumption function.

In the words of Keynes:

“Men are disposable as a rule and on

the average to increases their consumption as their income

increases, but hot by as much as the increases in their income.”

Properties of Consumption Behavior

of Community:

The psychological law of consumption

brings out the following properties of the consumption behavior

of the community:

(i) The level of consumption is

directly functionally related to the level of disposable income

= C = f(y)

(ii) With the rise in the level of

income, the consumption level also rises, but at a decreasing

rate = ΔC < Δy

(iii) As the level of income

increases, the households devote a part of the increase saving.

Symbolically: ΔY = ΔC + ΔS

The Keynesian consumption

function is now explained with the help of schedule and

a curve.

Schedule:

($ in billion)

|

Disposable Income (Y) |

Consumption (C) |

Saving (S) |

APC (C/Y) |

MPC (ΔC/ΔY) |

| 0 |

50 |

-50 |

|

|

|

100 |

100 |

0 |

1.00 |

0.5 |

|

200 |

150 |

50 |

0.75 |

0.5 |

|

300 |

200 |

100 |

0.67 |

0.5 |

In the schedule, it is shown that as

the nation’s disposable income increases, the aggregate

consumption at various levels of income also increases but at a

decreasing rate.

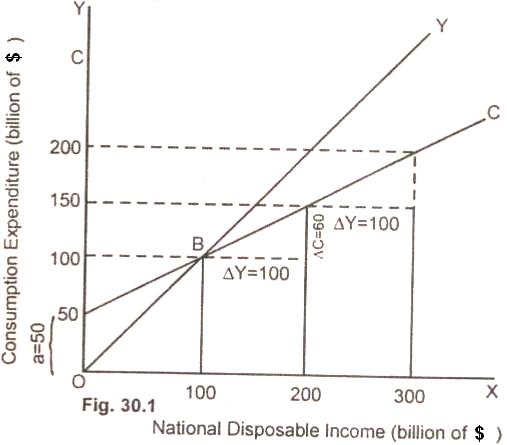

The same data is now shown in graph

30.1 below:

Diagram/Graph:

Following are the observations

about the functional relationship between the national

disposable income and the economy’s aggregate expenditure.

(i) At every point on the 450

line OY, a vertical line drawn to the income axis is at the same

distance from the origin as a horizontal line drawn to the

consumption axis. The 450 line thus is the line along

which expenditure equals real income.

(ii) The consumption function is

represented by consumption line (C). The consumption line C is

positively sloped indicating that as the disposable income

increases, the expenditure in the economy also increases.

(iii) The consumption line (C)

intercepts at Y axis showing negative saving of $50 billion

during a short period.

(iv) At point B the consumption line

(C) intersects the 450 helping line (OY) saving. At

point B, consumption equals disposable income and there is zero

saving. B is called the break even point.

(v) Left to the point B, the

consumption line C is above the income line Y. It indicates

negative saving.

(vi) Right to the point B, the

consumption line C is below the income line Y. It denotes

positive savings.

Summing up, the relationship

between consumption and disposable income is referred to

as consumption function. A consumption function tells

how much households plan to consume at various levels of

disposable income.

Relevant Articles:

|