Concept of

Propensity to Save/Saving Function:

Definition:

The

propensity to save schedule which for the sake of brevity is called the

propensity to save or saving function shows relation between saving and

disposable income at varying levels of income S = F(Y).

The propensity to save

schedule comes from subtracting consumption from income at each level of income.

Since saving represents the difference between the 45o guideline and the

consumption function, it may be positive or negative. The propensity to save

schedule can easily be derived from the

propensity

to consume schedule, in our example given earlier, (Click

here to read full example), the propensity to consume, is as follows:

|

Income ($ in billion) |

50 |

100 |

140 |

200 |

300 |

|

Expenditure ($ in billion) |

50 |

70 |

100 |

140 |

200 |

The

propensity to save schedule can easily be derived by subtracting the amount of

consumption from the corresponding amount of income. The saving schedule thus is

as follows:

|

Income ($ in billion) |

50 |

100 |

140 |

200 |

300 |

|

Save ($ in billion) |

0 |

30 |

40 |

60 |

100 |

Concepts of

Propensity to Save:

There are two concepts of

propensity to save:

(1) Average

Propensity to Save (APS).

(2) Marginal

Propensity to

Save (MPS).

(1) Average

Propensity to Save (APS):

Definition:

Average propensity to save is

the percentage of income saved at a given level of income (APS).

The average

propensity to save at any point can be found by dividing saving by income.

For

instance, If the disposable income is $100 billion and expenditure $80

billion on consumption goods, then the saving win be equal to $20 billion. The

average propensity at save will be = 0.2. The average propensity to save can also

be found by subtracting average propensity to consume from 1. In the above

example, the average propensity to consume is:

80/1000 =

0.8

So the average

propensity save will be 1 - 8 = 2

(2)

Marginal Propensity to Save (MPS):

Definition:

Marginal propensity to save is the ratio of change in saving to change

in income. The MPS measures the change in saving generated by a change in

income.

Formula:

MPS =

Change in Saving

Change in Income

MPS = ΔS

ΔY

It is also found out by

subtracting marginal propensity to

consume from 1. Thus:

MPS = 1 - MPC

Schedule

For APS and MPS:

($ in billion)

|

Disposable Income

(Y) |

Consumption Expenditure (C) |

Net Saving (S) |

Average Propensity to Save

(1 (1 - PC = PS) |

Marginal Propensity to Save

(1 - MPC = MPS) |

| A

1000 |

1100 |

$100 |

1

-1 = 1 |

1

- 9 = 0.1 |

| B

2000 |

2000 |

$000 |

1

- 1 = 0 |

1

- 6 = 0.4 |

| C

3000 |

2600 |

$400 |

1

- 0.86 = 0.14 |

1

- 5 = 0.5 |

| D

4000 |

3100 |

$900 |

1

- 0.77 = 0.23 |

1

- 3 = 0.7 |

| E

5000 |

3400 |

$1600 |

1

- 0.68 = 0.32 |

1

- 2 = 0.8 |

| F

6000 |

3600 |

$2400 |

1

- 0.6 = 0.4 |

1

- 1 = 0.9 |

| G

7000 |

3700 |

$3300 |

1

- 0.53 = 0.47 |

|

It is quite clear from the above saving schedule that as

the income increases, the average propensity to save and marginal propensity to

save also increases and as income decreases, the average propensity to save and

the marginal propensity to save also decreases.

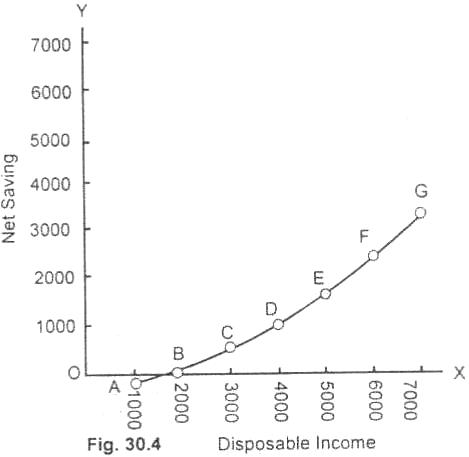

Diagram:

In figure (30.4) disposable income is measured along the X

axis and saving along the Y axis. At point A, the consumption expenditure

$1,100 billion against the disposable income of $1,000 billion. The

expenditure is more than the disposable income. There is dis-saving of $100 billion. The excess expenditure of

$100 billion is met either out of

accumulated saving or by borrowing. When income increases to $2,000 billion,

the expenditure also increases to $2,000 billion.

At point B, consumption is

exactly equal to expenditure. B is the break even point where C =Y. From B onward up to G point, saving goes or increasing with the increase in disposable income.

AG thus is the saving curve which has risen with the rise in income.

It may

here be noted saving as used by Keynes in consumption function is "real

saving" and ‘income is "real disposable income". The

saving function like the consumption function remain stable in the short period.

Relevant Articles:

|