Concept of

Marginal Efficiency of Capital (MEC):

Definition and Explanation:

Marginal efficiency capital (MEC) is a Keynesian concept.

According to J.M. Keynes, nations output depends on its stock capital. An

increase in the stock of capital increases output. The question is how much

increase in investment raises output? Well, this depends on the productivity of

new capital i.e. on the marginal efficiency of capital. Marginal efficiency of

capital is the rate return expected to be obtainable on a new capital asset over

its life time.

J.M. Keynes defines marginal efficiency of capital as the:

“The

rate of discount which makes the present value of the prospective yield from the

capital asset equal to its supply price”.

A businessman while investment in a

new capital asset, examines the expected rate of net return (profit) on it

during its lifetime against the supply price of capital asset (cost of capital

asset) if the expected rate of profit is greater than the replacement cost of

the asset, the businessman will invest the money in the project.

Example:

For example, if

a businessman spends $10,000 on the purchase of a new griding machine. We

assume further that this new capital asset continues to produce goods over a

long period of time. The net return (excluding meeting all expenses except the

interest cost) of the griding machine expected to be $1000 per annum. The

marginal efficiency of capital will be 10%.

(1000/10000) Χ (100/1) = 10%

Formula:

The following formula is used to know the present value of

aeries of expected income throughout the life span of the capital assets.

Sp = (R1/1+r)

+

(R2/1+r2)

+

............ = (Rn/1+rn)

Here:

Sp

= Stands for supply price of the new capital asset.

R1

+ R2 - Rn = Stands for returns received on yearly basis.

R = It is the rate of discount applied each the years.

Schedule:

According to

J.M. Keynes, the behavior of investment in

respect of new investment depends upon the various stock of capital available in

the economy at a particular period of time. As the stock of capital increases in

the economy, the marginal efficiency of capital goes on diminishing. The MEC

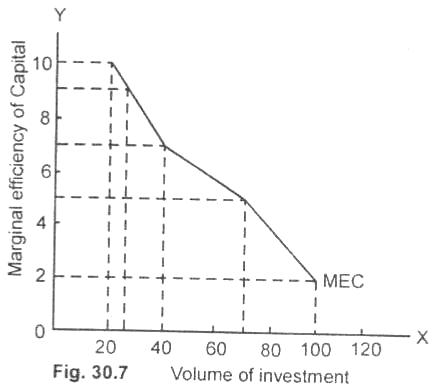

curve is negatively sloped as a shown in the figure 30.7.

|

Investment ($ in

billion) |

Marginal Efficiency of

Capital |

|

20 |

10% |

|

25 |

9% |

|

40 |

7% |

|

70 |

5% |

|

100 |

2% |

Diagram/Curve:

In the above table, it is shown when stock of capital is

equal to $20 billion, the marginal efficiency of capital is 10% while at a

capital stock of $100 billion, it declines to 2%. This investment demand

schedule when depicted graphically in figure 30.7 gives us the investment demand

curve which goes on sloping downward from left to right.

Relative

Role of MEC and the Rate of Interest:

The

MEC and the rate of interest are the two important

factors which affect the volume of new investment in a country. An investor

while making a new investment, weighs the MEC of new investment against the

prevailing rate of interest. As long as the MEC is higher than the rate of

interest, the investment will be made till the MEC and the rate of interest are

equalized.

For example, if the rate of interest 7%, the induced investment will

continue to be made till the MEC and the rate of interest are equalized. At 7%

rate of interest, the new investment will be $40 billion. In case, the rate

of interest comes down to 2%, the new investment in capital assets will be $100 billion.

Summing up, if investment is to be increased in the country, either

the rate of interest should go down or MEC should increase.

Relevant Articles:

|