Propensity to Consume:

Meaning and Definition of Propensity

to Consume:

The classical economists were of the view that the

supply of saving was determined by the rate of interest prevailing in the

country. According to them, the higher the rate of interest, the larger is the

saving and so less is the consumption.

Keynes disagreed with the above view.

According to him interest is not the primary determinant of an individual’s

saving and consumption decisions. It is primarily the individual’s real income

which determines his, saving and consumption decisions. J.M. Keynes has

developed two concepts:

(i) Average

Propensity to Consume.

(ii) Marginal

Propensity to Consume to Analyze the Consumption Function.

Explanation:

These two

concepts are now explained in brief:

(1) Average Propensity to Consume

(APC):

Average propensity to consume ( APC) may be defined as:

Definition:

"A

ratio of total consumption to total disposable income for different levels of

disposable income It is calculated by dividing the amount of consumption by

disposable income for any given level of income".

Example:

For instance, when nation’s

disposable income is $2,000 billion, consumption expenditure is $1,500

billion, the average propensity to consumption is 1500/2000 = 0.75.

This shows that

out of the disposable income of $2,000 billion, 75% will be used for

consumption purposes. The APC declines as income increases because the

proportion of income spent on consumption decreases. The average propensity to

consume spent on consumption decreases. The average propensity to consume at any

level of income is expressed in equation as C/Y. Here C stands for consumption Y

for income.

Formula:

APC = C

Y

Diagram:

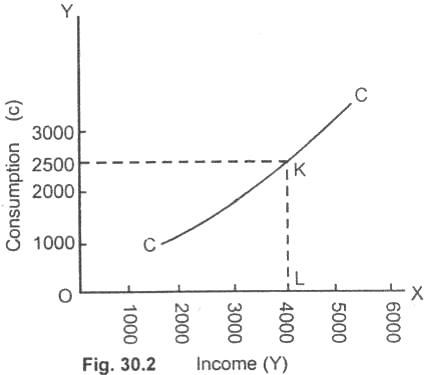

In the Fig.(30.2) income is plotted on OX axis and

consumption along OY. CC curve represents the propensity to consume schedule. At

point K, the average propensity to consume is equal to 0.62.

KL/OL = (C/Y) i.e., 2500/4000 or

25/40 = 0.62

APC implies a point on

the curve C which indicates the ratio of income consumed. The C curve is made up

of a series such points.

(2) Marginal

Propensity to Consume (MPC):

Definition:

The concept of

marginal propensity to consume is very important is macro

economics. J.M. Keynes has defined marginal propensity to

consume (MPC):

"As the relationship between a change in consumption (ΔC)

that resulted from a change in disposable income (ΔY)".

Formula:

It is

found out by dividing change in consumption to a given change in disposable

Income.

MPC = Change in Consumption = ΔC

Change in Income ΔY

Example:

Thus we make this concept clear by taking an example, let us

suppose the disposable income rises from $2000 billion to $3000 billion ( by

$1000 billion) and the consumption expenditure increases from $1500 billion to

$2000 billion (by $500 billion).

The marginal propensity to consume is:

ΔC/ΔY = 500/1000 = 1/2 = 0.5

All the concepts of consumption function are now

explained whit help of schedule and a diagram.

Schedule

For Propensity to Consume:

($

in billion)

|

Disposal Income (Y) |

Consumption Expenditure (C) |

Average Propensity to Consume (APC = C/Y) |

Marginal Propensity to Consume (MPC = ΔC/ΔY) |

|

A 1000 |

1100 |

1.1 |

800/1000 = 0.9 |

|

B 2000 |

2000 |

1.0 |

600/1000 = 0.6 |

|

C 3000 |

2600 |

0.86 |

500/1000 = 0.5 |

|

D 4000 |

3100 |

0.77 |

300/1000 = 0.3 |

|

E 5000 |

3400 |

0.68 |

200/1000 = 0.2 |

|

F 6000 |

3600 |

0.6 |

100/1000 = 0.1 |

|

G 7000 |

3700 |

0.53 |

|

The

reader can easily understand from the above schedule that with the increase in

the disposable income, the propensity to consume decreases and conversely with a

fall in income, the propensity to consume and the marginal propensity to consume

increases. The consumption schedule can also be explained with the help of a

curve which is given below:

Diagram

For Propensity to Consume:

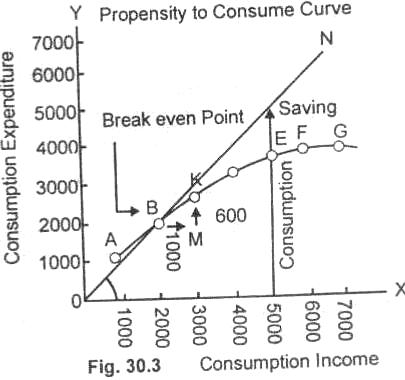

In the figure (30.3), disposable income is measured along

the horizontal axis OX and consumption along the vertical axis OY. Let us now

draw 450 helping line from O to ON. If we take any point on the 450 helping line,

income will be exactly equal to expenditure. The curve AG represents the income

consumption schedule, indicating the propensity to consumer at various levels of

income. Point A which is above 450 helping line, shows us that the expenditure is

greater than its income.

This deficit in income can be converted either by

borrowing or from the sale of assets. At point B, consumption expenditures

exactly equal to disposable income and there is neither saving nor dis-saving.

This point is known is as break even point.

From B onward

up to G, the curve lies

below the 450 helping line. This shows that the consumption expenditure is less

than the disposable income. Net saving is measured by the distance from the

propensity to consume curve up to 450 helping line.

For example, when the income

is $5,000 billion, the expenditure is $3400 billion and saving $1,600

billion.

Marginal propensity to consume curve can also be

illustrated from the very same figure. At point B, income is $2,000 billion

and is equal to expenditure, i.e., $2,000. When income increases from

$2,000 billion to $3,000 billion, consumption increases only by $600

billion.

Now we move from point B towards right up by

$1,000 billion. BM line

shows as the increases in income. Then we go vertically until we reach point K.

MK line indicates addition made to the total consumption. It is equal to $600

billion. So the marginal propensity to consume will be equal to $600/$1000 = $6.

Relevant Articles:

|