Short Run

Equilibrium of the Price Taker Firm Under Perfect Competition:

Definition and Explanation:

By short run is meant a

length of time which is not enough to change the level of fixed

inputs or the number of firms in the industry but long enough to

change the level of output by changing variable inputs.

In short

period, a distinction is made of two types of costs (i) fixed

cost and (ii) variable cost.

The fixed cost in the form of fixed

factors i.e., plant, machinery, building, etc. does not vary

with the change in the output of the firm. If the firm is to

increase or decrease its output, the change only takes place in

the quantity of variable resources such as labor, raw material,

etc.

Further, in the short run, the demand curve

facing the firm is horizontal. No new firms enter or leave the

industry. The number of firms in the industry, therefore, remain

the same. Under

perfect

competition, the firm takes the price of the product as

determined in the market. The firm sells all its output at the

prevailing market price. The firm, in other words, is a

price taker.

Equilibrium

of a Competitive Firm:

The short-run equilibrium of a firm

can be easily explained with the help of marginal revenue = marginal cost approach or

(MR = MC)

rule.

Marginal revenue is the change in total revenue that

occurs in response to a one unit change in the quantity sold.

Marginal cost is the addition to total cost resulting from the

additional of marginal unit. Since price is given for the

competitive firm, the average revenue curve of a price taker

firm is identical to the marginal curve. Average revenue (AR)

thus is equal to marginal revenue (MR) is equal to price (MR =

AR = Price).

According to the marginal revenue

and marginal cost approach or (MR = MC) rule , a price taker

firm is in equilibrium at a point where marginal revenue (MR) or

price is equal to marginal cost The point where MR = MC = Price,

the firm produces the best level of output. From this it may not

be concluded that the perfectly competitive firm at the

equilibrium level of output (MR = MC = Price) necessarily

ensures maximum profit. The fact is that in the short period, a

firm at the equilibrium level of output is faced with four types

of product prices in the market which give rise to following

results:

(i) A firm earns supernormal

profits.

(ii) A firm earns normal profits.

(iii) A firm incurs losses but does

not close down.

(iv) A firm minimizes losses by

shutting down. All these short run cases of profits or losses

are explained with the help of diagrams.

Determining

Profit from a Graph:

(1) Profit Maximizing Position:

A firm in the short run earns

abnormal profits when at the best level of output, the market

price exceeds the short run average total cost (SATC). The short

run profit maximizing position of a purely competitive firm is

explained with the help of a diagram.

Diagram/Graph:

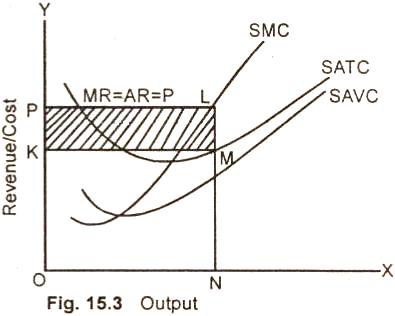

In the figure (15.3), output is

measured along OX axis and revenue / cost on OY axis. We assume

here that the market price is equal to OP. A price taker firm

has to sell its entire output at this prevailing market price

i.e. OP. The firm is in equilibrium at point L. Where MC = MR.

The inter section of MC and MR determine the quantity of the

good the firm will produce.

After having determined the

quantity, drop a vertical line down to the horizontal axis and

see what the average total cost (ATC) is at that output level

(point N). The competitive firm will produce ON quantity of

output and sell at market price OP. The total revenue of the

firm at the best level of output ON is equal to OPLN. Whereas

the total cost of producing ON quantity of output is equal to

OKMN. The firm is earning supernormal profits equal to the

shaded rectangle KPLM. The per unit profit is indicated by the

distance LM or PK.

It may here be noted that a firm

would not produce more than ON units because producing another

unit adds more to the cost than the firm would receive from the

sale of the unit (MC > MR). The firm would not stop short of ON

output because producing another unit adds more to the revenue

than to cost (MR > MC). Hence, ON is the best level of

output where profit of the firm is maximum.

(2) Zero

Profit of a Firm:

A firm, in the short run, may be

making zero economic profit or normal economic profit. It may

here be remembered that although economic profit is zero, all

the resources including entrepreneurs are being paid their

opportunity. So they are getting a normal profit the

case of normal profits of a firms at break even price is

explained with the help of the diagram 15.4.

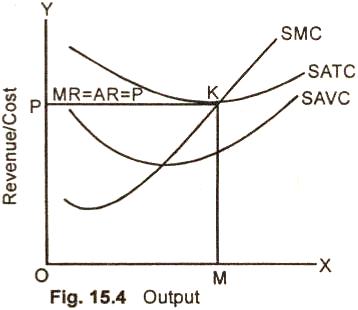

We assume in the figure (15.4) that

OP is the prevailing market price and PK is the average revenue,

marginal revenue curve. At point K, which is the break even

price for a Competitive firm, the MR, MC and ATC are all equal.

The firm produces OM output-and sells at market price OP. The

total revenue of the firm to equal is the area OPKM. The total

cost of producing OM output also equals the area OPKM. The firm

is earning only normal profits. It is a situation in which the

resources employed by the firm are earning just what they

could-earn in some other alternative occupations.

(3) Loss

Minimizing Case:

The firm in the short rue is

minimizing tosses if the market price is smaller than average

total cost but larger than average variable cost. The loss

minimizing position of a price taker firm is explained with the

help of a diagram.

We assume in the figure (15.5) that

the market price is QP. The firm is in equilibrium at point N

where MR = MC. The firm's best level of output is OK which is

sold at unit cost OP. The total revenue of the firm is equal to

the area OPNK. The total cost of producing OK quantity of output

is equal to OTSK. The firm is suffering a net loss equal to the

shaded area PTSN.

The firm at price OP in the market

is covering its full variable cost and a part of the fixed cost.

The loss of part of fixed cost equal to the shaded area PTSN is

less than, the firm would incur by closing down. In case of shut

down, the firm has to bear the total fixed cost ETSF. The firm

thus by producing OK output and selling at OP price is

minimizing losses. Summing up, in the short run the firm will

not go out of business for as long as the loss m staying the

business is less than the loss from closing down.

(4) Short Run Shut Down:

The price taker firm in the

short-run minimizes losses by closing it down if the market

price is less than average variable cost. The shut down position

of a Competitive firm is explained with the help of a diagram.

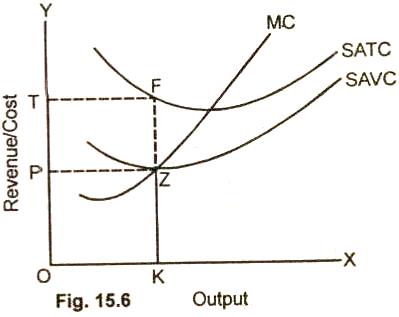

In this figure (15.6) we assume that

the market price is OP. The firm, is in equilibrium at point Z

where MR = MC. The firm produces OK output and sells at OP unit

cost. The total revenue of the firm is equal to the area OPZK.

Whereas .the total cost producing OK output is OTFR. The firm is

suffering a net loss of total fixed cost equal to the area PTFZ.

The firm at point Z is just covering average variable costs.

If the price falls below Z, the

competitive firm will minimize its losses by closing down. There

is no level of output which the firm can produce and realize a

loss smaller than its fixed costs. It is therefore a shut

down point for the firm. Operate When Price is > average

variable cost.

Relevant Articles:

|