Short Run

Supply Curve of a Price Taker Firm:

Definition and Explanation:

In a competitive market, the

supply curve of a firm is derived from its

marginal cost curve. Supply curve

is that portion of the marginal cost curve which lies above the

average variable cost curve.

As we already know, the aim of

the firm is to maximize profits or minimize losses. The profits

are increased it the difference between total receipts and total

costs is maximized. When a firm undertakes the production of a

particular commodity, it has to pay remuneration to all the

factors of production employed. The remuneration or cost of the

firm for a short period can be divided into two parts, fixed

costs and variable costs. If from the sale of the commodity

produced, a firm is earning much more than what it has to spend

on it. We say a firm is earning abnormal profits if the total

revenue of the firm is equal to total cost, the firm is getting

normal profits. In both these cases, it is profitable for the

firm to produce the commodity. But if the total receipts fall

short of total costs, then three situations can arise.

(i) A firm is not in position to

meet its variable costs.

(ii) A firm is able to cover its

variable costs.

(iii) A firm is covering its full

variable costs and a part of the fixed costs.

Let us explain all these

situations with the help of a curve.

Diagram:

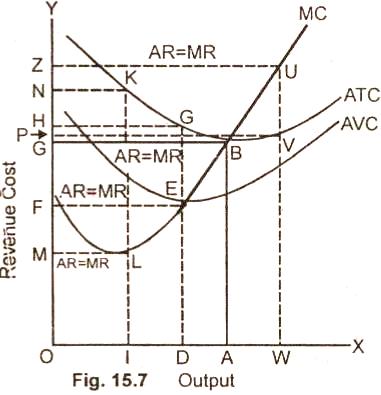

(1) In the

figure. (15.7) there are three costs curves, AVC curve, ATC

curve and MC curve. ATC curve includes the average variable cost

and average fixed cost of a firm. Average variable cost is

represented by the AVC curve which lies below the ATC curve. Let us

suppose now that at price OM, a firm supplies an

output equal to 01 because MR = MC at point I.

The total

receipts of the firm at OM price are thus, equal to OILM, while

the total costs are equal to OIKN. At this price, a firm is

undergoing too much losses which are represented by the area

MLKN. It is not even meeting its full variable cost as the AVC

curve lies much above this price line. A firm shall have to

close down its operations for minimizing losses in the short run

(shut

down cases).

(2) At price

OF, a firm is in equilibrium at point E where MR = P = AR. It

produces OD amount of output and is just able to cover its

variable cost. The total receipts of the firm at OF price are

equal to ODEF and the total cost ODGH. As the total receipts

of-the firm fall short of total cost, so it Is not advantageous

for the firm to carry on production in the short run. The firm

shall close down its operation as the full fixed cost equal to

the area FHGE is not met. The point E where MR = MC = minimum of

AVC is also a shut down point of the firm.

(3)

In case

the price settles somewhere between F and G, then the firm will

be meeting its full variable costs and a part of the fixed

costs. It, may prefer to produce because if the concern is

closed down the whole of the fixed cost is to be met. This, of

course can happen in a short period. When the period is long the

total receipts of the firm must be equal to total cost and the

firm must earn normal profit.

(4)

If the

price in the market is OG, the firm is in equilibrium at point

B. Here the total receipts of the firm, i.e., OABG are equal to

the total cost, i.e., OABG. A firm is earning normal profits and

it is profitable for it to carry on production. By normal

profits in economics we mean the level of profit which is just

sufficient to induce an entrepreneur to stay in the industry.

The amount is equal to the remuneration which an entrepreneur

can get in an alternative occupations. If the entrepreneur is

not paid the amount equal to this normal profit, he will move to

the other alternative industry where he could got this amount.

If price,

rises above OG, then firm is getting abnormal profits. For

instance, the firm is producing best level of output by equating

MR = MC at point U and selling at price OZ, the total revenue of

the firm will be OWUZ and total cost OWVP. There is thus an

abnormal profit equal to PVU2.

Summing up,

we can say, that if price falls below the lowest point on the

AVC curve, the firm will not produce any output because it is

not able to cover even its total variable costs. But if the

price is such that it covers its total variable costs, then the

firm may carry on production for a short period. So is also the

case when it covers its full variable costs and a part of the

fixed costs. In the long period, if the firm does not cover its

full costs, it will have to dose down its operations sooner or

later. So we conclude that the supply curve of the firm that can

be regarded as that portion of the MC curve which lies above the

AVC curve and not which lies below the AVC curve because it is

only at the lowest point on the AVC curve that some output is

forthcoming and not below this point.

The supply

curve of the firm or the rising portion of the MC curve which

lies above the AVC curve can be split up into two parts. One

part consists of that portion which lies above the lowest point

of the ATC curve. If the price line representing MR = AR

intersects the MC curve at any point on this rising portion, the

firm will be earning abnormal profit (see fig. 15.7). The second

part of the supply curve of the firm extends from the lowest

point of the AVC curve to the lowest, point of the ATC curve. If

price line representing MR = AR passes through the lowest point

of the AVC curve, the firm is covering only total variable

costs. If the price line cuts the MC curve at any point above

the lowest point of

the AVC curve and below the lowest point of ATC curve, the firm

will be meeting its total variable costs and a part of the fixed

costs but not the total costs. The total costs are met only when

the price line forms a tangent to the ATC curve.

Relevant Articles:

|